FIRST SOUTHERN NATIONAL BANK: WE BELIEVE IN YOU

Clarifying A Brand & Translating Magic

As a community bank with just over 40 years under its belt, First Southern National Bank had gained a reputation as a strong institution built by leveraging a relatively small number of very profitable relationships. Since the beginning, a high value was put on in-person conversations and word-of-mouth referrals and the bank had utilized that approach to drive steady success. By 2018, the world around them was changing. Rather than rest on their laurels, leadership saw declining numbers of younger customers and the emergence of non-traditional fintech competitors as a call to more clearly define who they were to the world at large.

Up until 2018, First Southern had done very little paid advertising. Beyond that, each market had its interpretation of the company brand. From messaging to fonts to colors to photos to signage, for people without a personal connection to the banks, the signals were mixed at best. Along with the need for a cohesive brand to unite their locations across geography and channels, they also needed to translate the magic of in-person connections to platforms like websites, digital banking, mobile apps, and interactive teller machines.

THE CHALLENGE

Define the brand and build a theme to connect emotionally with potential customers.

Internal Focus

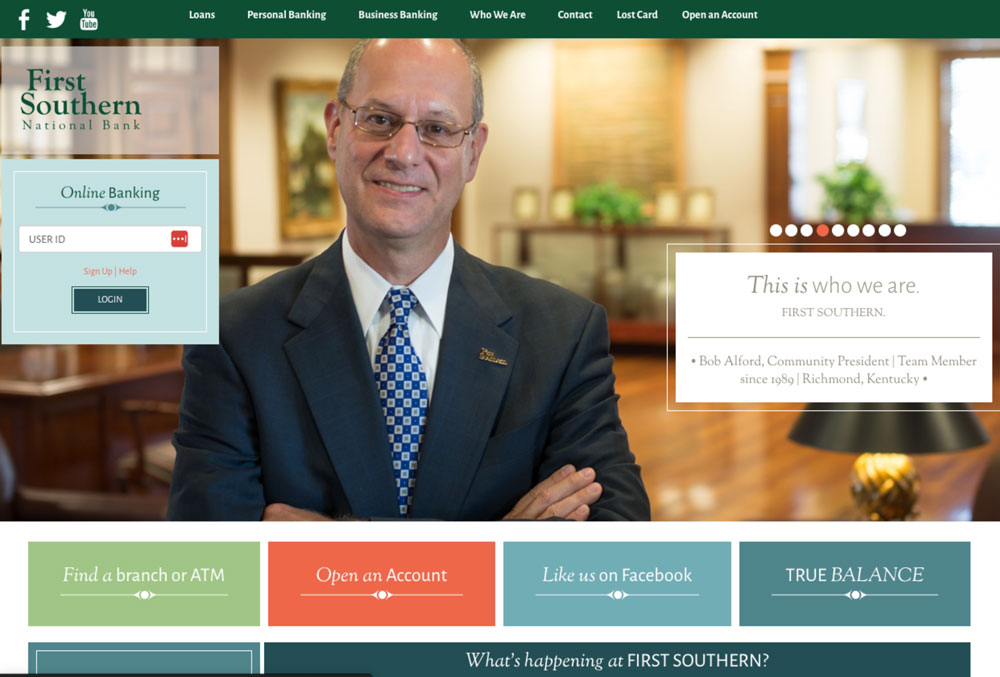

We analyzed existing materials to identify what worked and what didn’t, aiming to isolate their identity from amidst the clutter. Despite strengths, such as a partially launched rebrand and digital tools, there were clear issues. Inconsistencies in language and visual branding across platforms made it seem like different banks. Additionally, their content was overly focused on their team rather than their customers and solutions.

Solutions Focus

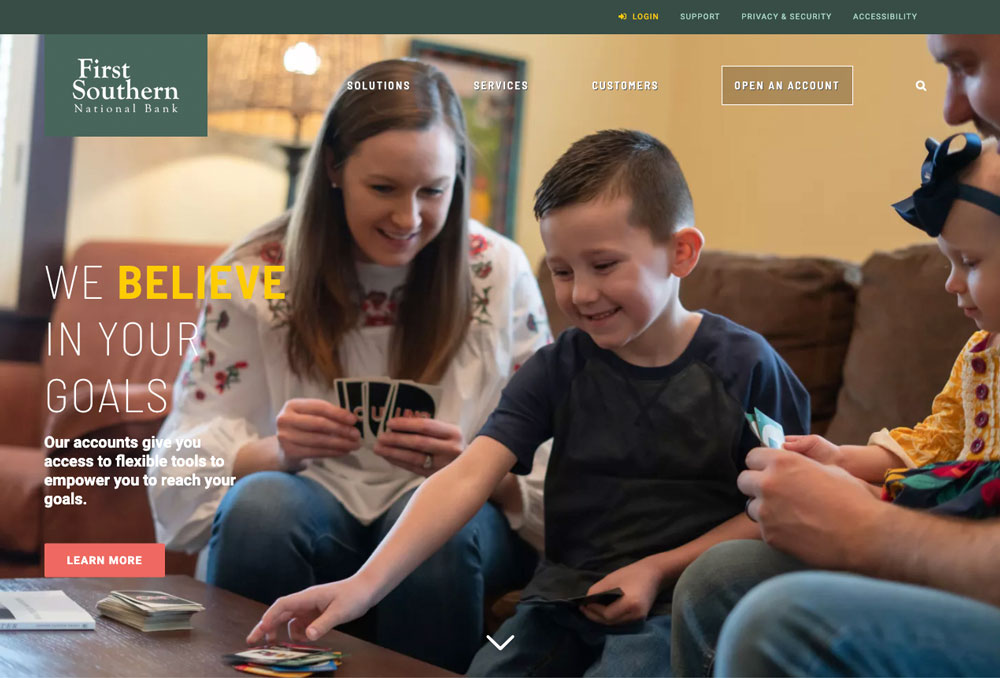

While showcasing great team members might seem natural, it’s crucial to first communicate why potential customers should connect with your brand. The adage, ‘No one cares how much you know, until they know how much you care,’ resonated with us. First Southern wasn’t competing on rates or gimmicks but on genuine investment in their customers’ success. Through leadership meetings, team surveys, and industry analysis, we identified their core strength: a commitment to coaching customers toward financial freedom. This led to the tagline, ‘WE BELIEVE IN YOU.’

THE SOLUTION

It became clear that consistency in messaging and visuals was task one. To run effective advertising, we had to begin by building brand standards (they had none), a new website, new print materials, and a new approach to social media and email. In short, we had to rebuild everything but the logo from the ground up.

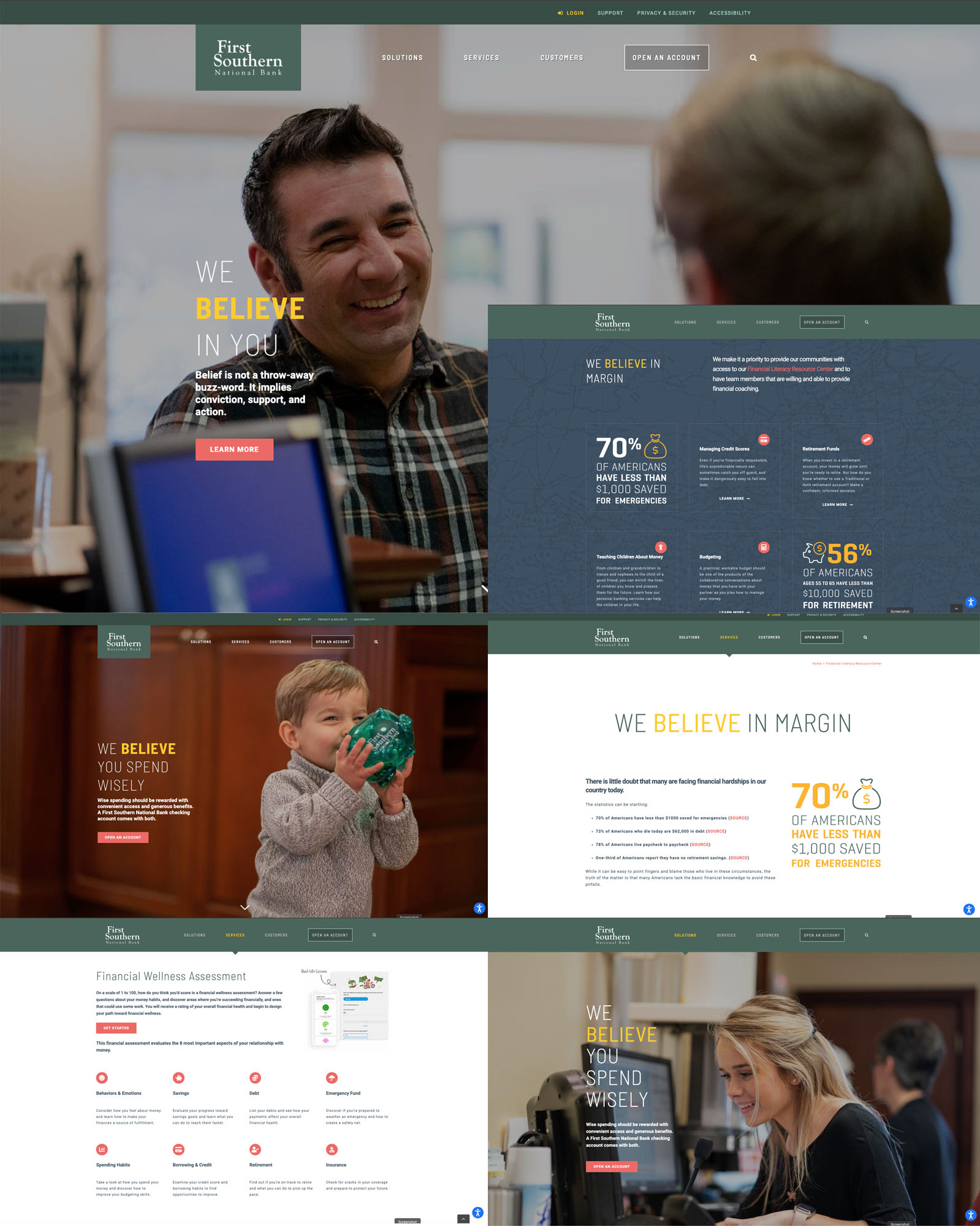

When we arrived, the existing First Southern website was a combination of internal cheerleading and external utility. It did a good job of displaying smiling team members and allowing existing customers easy access to necessary login links and contact numbers, but it was not built to convince non-customers to make the switch.

In addition to enforcing the emotional appeal of the “WE BELIEVE IN YOU” messaging, we also needed to create a clearer path for potential customers to learn how their products could improve their financial lives. This drove the decision to build a navigation framework that more effectively serviced prospects. Instead of giant login boxes and utility links, we shrunk utility links and placed them in a clearly visible but much smaller nav bar at the top of each screen. The main navigation was then divided into Solutions, Services, and Customers, with the only prominent button being one to sign up for an account.

We also made a conscious decision to focus on customer imagery first. Photography of real customers was captured and utilized prominently. We also collected and shared video testimonials in the website and ad content. When team members were featured, we ditched the smiling portraits addressing the camera and focused on shots of employees servicing customers.

Prior to this project, First Southern had made minimal investments in advertising. There were billboards here and there and many local branches sponsored athletic teams and made other “pay-to-play” investments to gain access to potential customers. This meant it was necessary to stagger investments over time to increase the comfort level of leadership as results came in. The great news, though, was there was very little existing advertising to contradict.

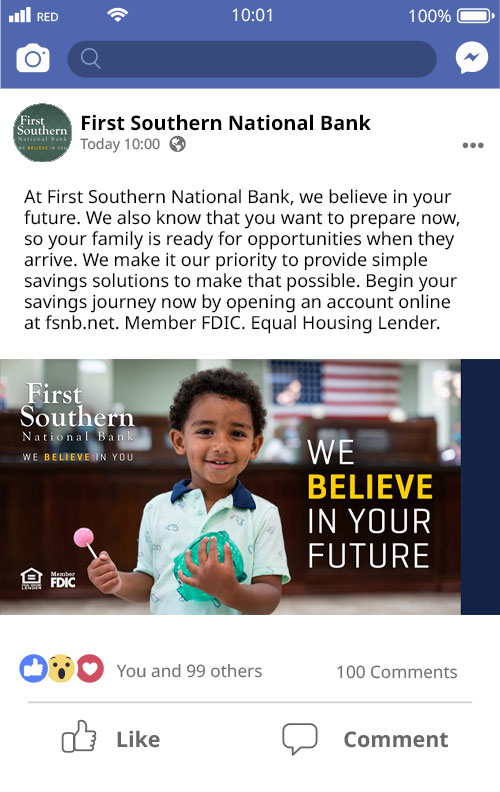

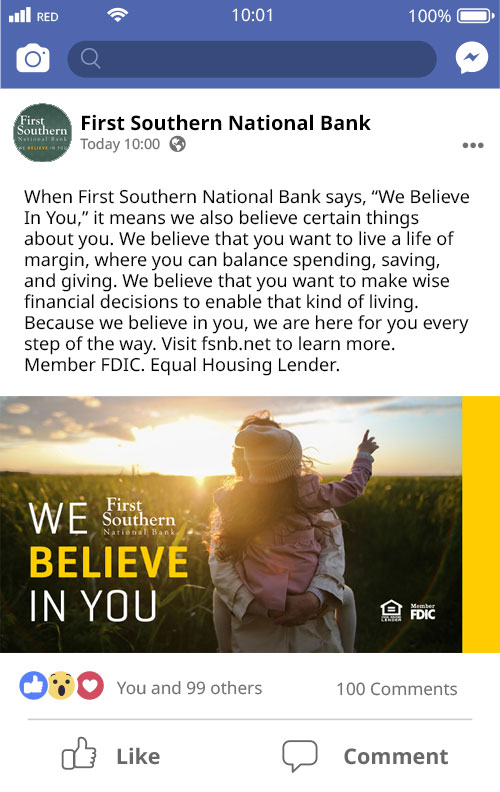

Digital advertising allows precision targeting and extensive measurement of effectiveness. Unlike traditional advertising, it is largely possible to scale your investment over time, make adjustments on the fly, and measure results to justify increased investment in near real-time. This seemed like a great fit for First Southern. Campaigns were built and launched on Meta and Google Ad networks utilizing a variety of static and dynamic assets.

In time, advertising would expand to include local radio, printed media, and streaming TV, all delivering the consistent message that “WE BELIEVE IN YOU.”

As all marketers know, repetition over time and across channels is the key to building affinity and loyalty. To that end, we knew that our messaging and visual identity could not be isolated to digital channels alone.

WE BELIEVE IN YOU was emblazoned across banners, hats, pens, brochures, t-shirts, debit cards, and more as we sought to reinforce our message and build consistency. A few examples are displayed and a link to a list of deliverables with attached timelines is included.

It was also important that we had an impact on internal sentiment, training, and recruitment. This required the creation of internal materials as well as presentations to large and small groups of team members.

Helping customers make wise financial decisions is always a part of the equation for First Southern. However, their historic approach generally required one-on-one coaching to be effective. In a world where near-limitless knowledge is at our fingertips, we offered them opportunities to impact more people by providing educational resources online.

Financial Literacy Resource Center

Facing the task of creating an online content library to provide thousands of community members with the knowledge they needed to make wise financial decisions was a daunting task. Thankfully, it wasn’t a challenge that was unique to First Southern. Numerous vendors were ready to provide the resources we needed.

After a research period, we decided to partner with Banzai, a leader in the financial literacy space in schools, who was in the process of moving further into adult and community education. Banzai provided us with interactive quizzes, courses, articles, and virtual coaches to help First Southern customers grow their knowledge base. Access to these resources is available on fsnb.net and on Banzai’s co-branded site at the link below.

My Credit Manager

It is no secret that a healthy credit score is crucial on the road to financial freedom. Instead of just providing information on how anyone can improve their credit profile, First Southern partnered with Array to provide free credit monitoring for every customer.

Customers can access a comprehensive credit report anytime they’d like within First Southern Digital Banking. This allows them to monitor the impact of wise financial decisions on their credit score quickly and easily. They even have the opportunity to activate identity and credit monitoring services to protect them from identity theft. Learn more at the link below.

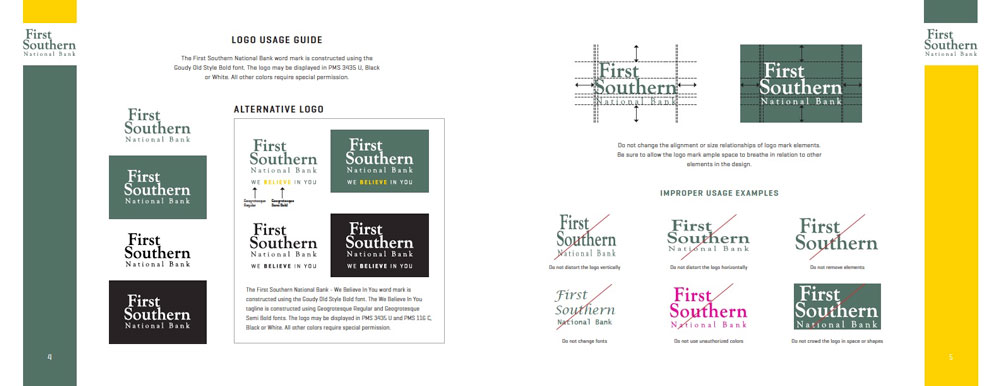

As mentioned previously, First Southern had never built or enforced formal brand standards for their logo usage, color choices, or corporate fonts. To ensure consistency across platforms and branch locations spread out around the state, we needed to establish guidance and a review process for materials.

In addition to a visual standards manual, we also introduced a formal project request workflow, a project management solution, and required approval for the production of all materials ordered by branch locations. Over time, this evolved into the creation of an online marketing materials portal where local leaders could customize and order pre-designed pieces on demand.

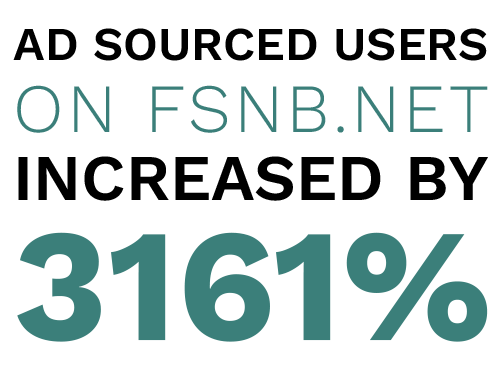

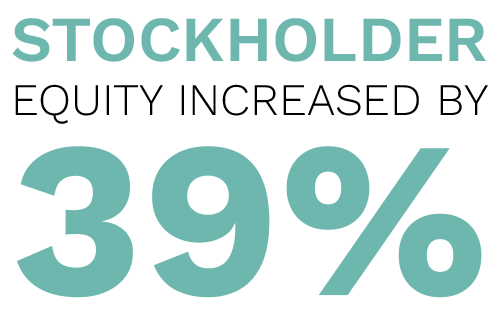

THE RESULTS

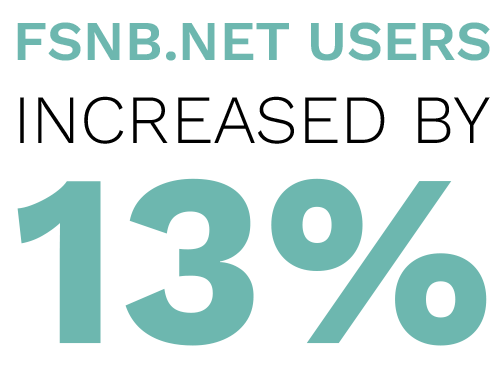

From 2018 through 2023, the bank saw its overall assets grow by more than 42% and its year-over-year net income grow by as much as 61% (from 2021 to 2022). Beyond those numbers, impacts could be measured all around.

FROM 2018 TO 2023

SOURCED FROM GOOGLE ANALYTICS